USDJPY provides potential trade after holding a key Fibonacci level

12 August 2022The USDJPY has been in an extremely strong upward trend since September 2021. This pair’s recent price action has also been charactarised by relatively weak retracements as it has trended higher. Inflationary pressures have acted as a strong catalyst for the USD against most other currencies further aided by the Federal Reserve taking a strong stance against inflation with a series of aggressive interest rate hikes. At the same time, the JPY has remained weak as the Central Bank of Japan has refused to intervene and shift from its dovish stance.

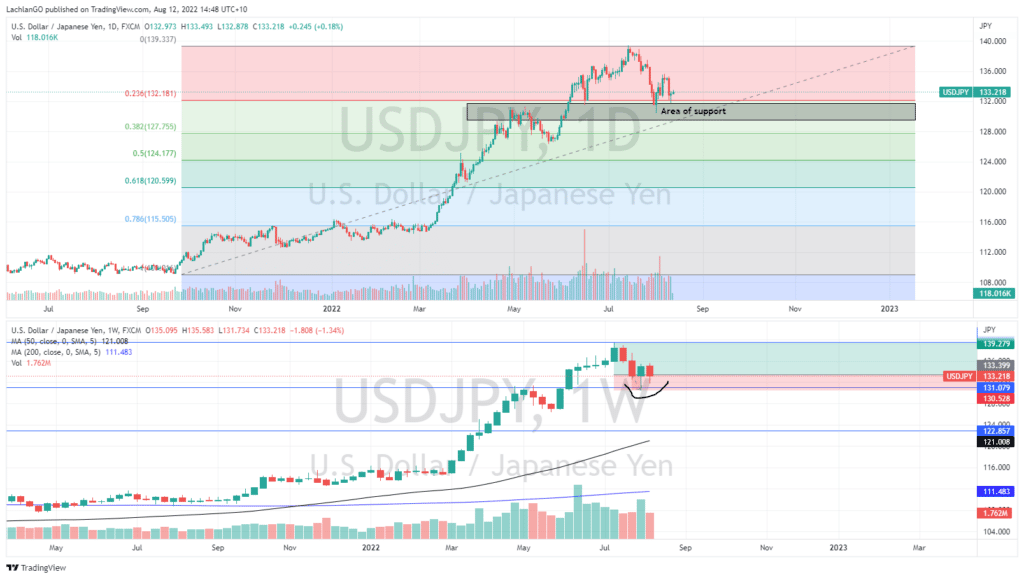

The most recent retracement shows the potential for a good risk/reward Long trade. On the chart, it can be seen that the price has pulled back to the 23.60% Fibonacci level, which is at 132/133JPY. This area also doubles as a support zone with the prior resistance level becoming a level of support which is another sign that the trend may continue.

On the weekly chart, the characteristics of the candlesticks near the support zone also support the premise that the price may bounce. The candles have long wicks touching the support area indicating that the buyers are soaking up the supply. They have also closed near their opening price again showing how buyers are soaking up the supply.

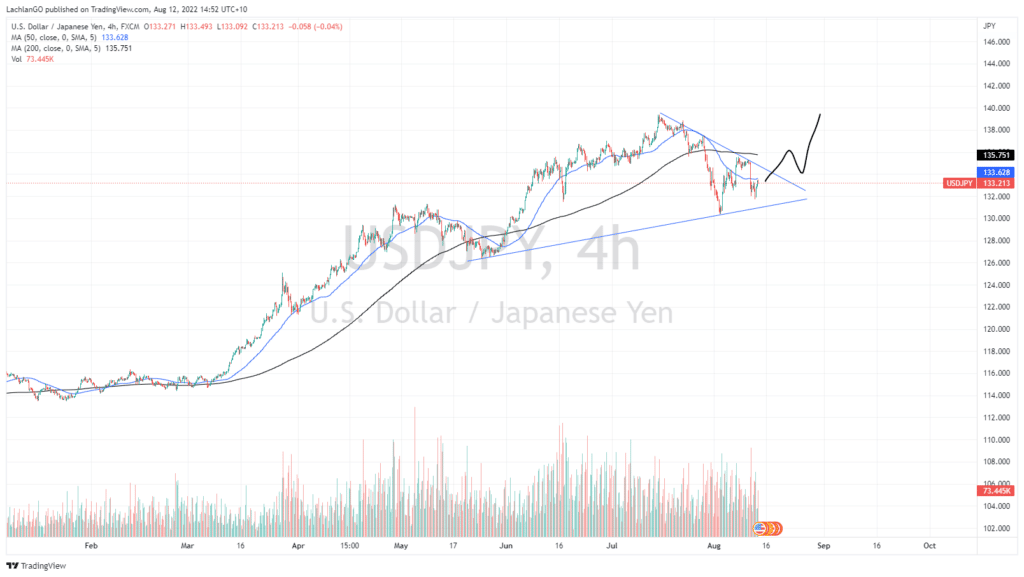

The 4-hour chart shows a consolidation of the price forming a triangle, with the potential to break out to the upside. This may provide an alternative entry signal for the same overall strategy. An important aspect to remember when trading this strategy is to ensure that price occurs with relatively high volume. Large volume indicates that buyers are regaining control over the price, and that sellers have become exhausted.

Potential risks

There are some risks with this trade. Firstly, the pair is already quite overextended with the price at multi-decade highs. In addition, with US inflation fears potentially easing and interest rate hikes priced in already, the current price may be near its peak.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

The week ahead –RBNZ, RBA and FOMC in the spotlight and set to drive the AUD, NZD and USD

US equity markets finished off the week with a blockbuster of a session, pushing all the major indices to a 4th straight week of gains with the growth heavy Russell 2000 (+4.93%) outperforming the “Value” Dow (+2.92%) hammering home that risk on was the overriding narrative of the week. This was the first time since November 2021 that the b...

Previous Article

US stocks give up early gains as bulls fail to hold key support and yields rise

US indexes finished mixed with early gains on a post CPI honeymoon and a soft PPI were erased during the session as investors realised they may have b...