US stocks extend sell-off, yields spike, GBP flash crashes

27 September 2022Wall St extended its sell-off in Mondays session, continuing on from Friday (albeit not as pronounced) against a backdrop of spiking bond yields, growth concerns and turmoil in the FX market.

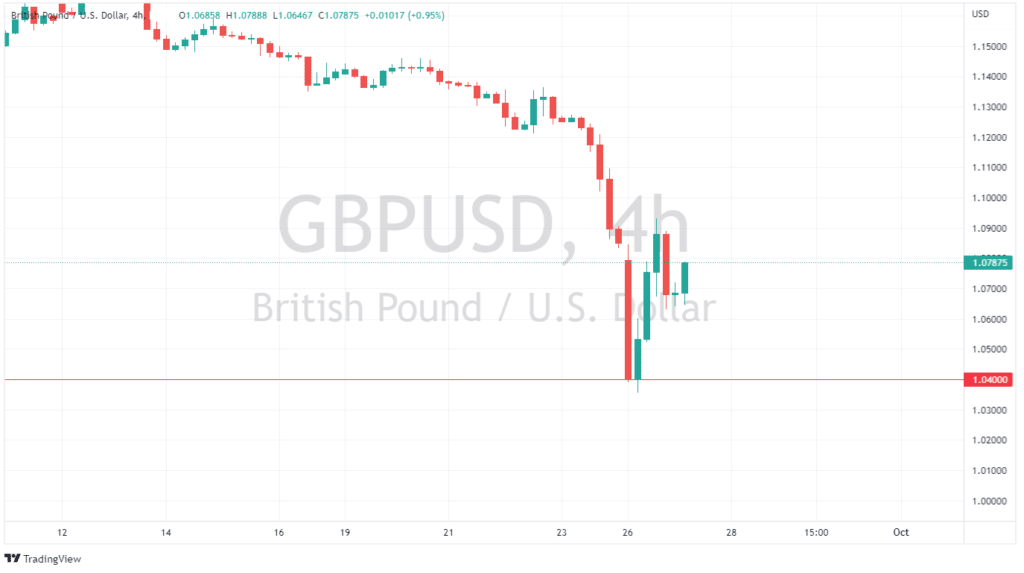

The S&P 500 closed at it’s lowest since late 2020 and the Dow slipped into bear market territory as investors fled risk assets. The USD was again dominant helped along by further fallout from the UK’s fiscal plans that saw GBPUSD flash crash below 1.04 to new all-time lows mid session.

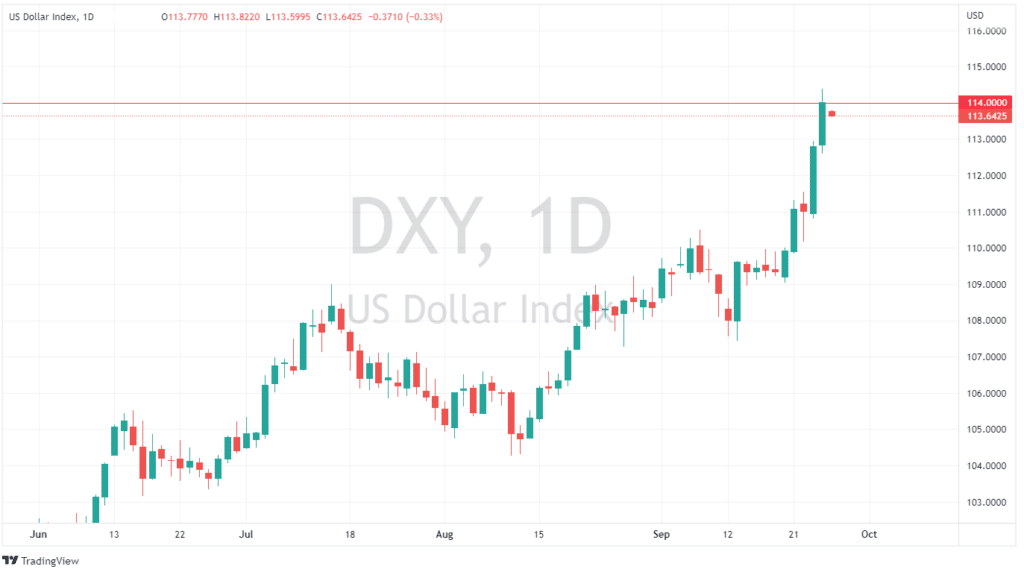

The US Dollar index remained firmer and rose back above the 114.00 level also benefitting from macro fundamentals such as relative US economic outperformance and demand for the Greenback amid a subdued risk sentiment. The Index is up a stunning 4% in the last 5 days – its biggest such move since the peak of the COVID Panic in March 2020.

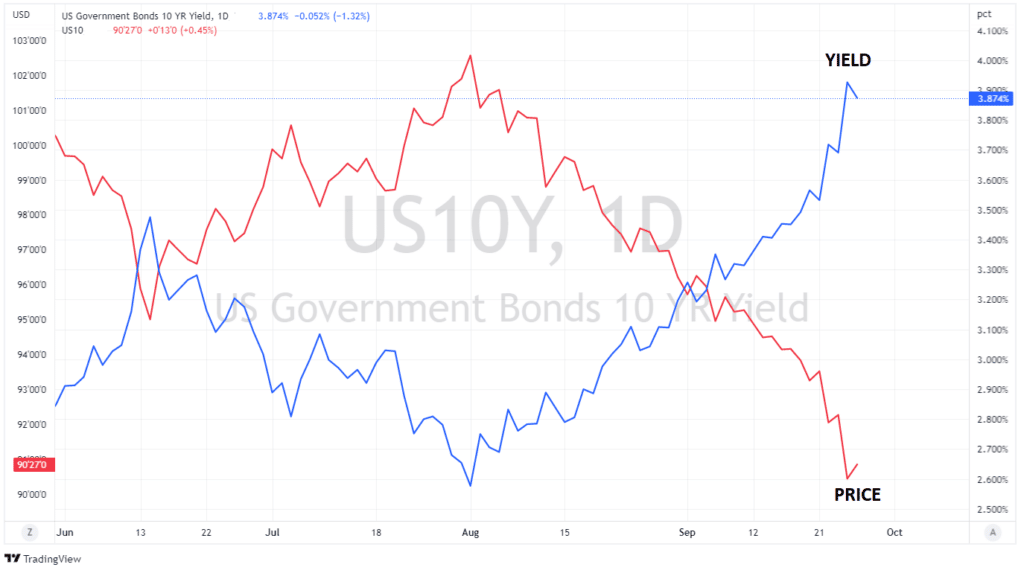

Another big factor in recent US dollar strength is the steep rise in the US 10 year bond yield as Bonds continue to sell off (Price moves inversely to yield) on the back of the a Hawkish Fed raising market expectations of their rate hiking trajectory.

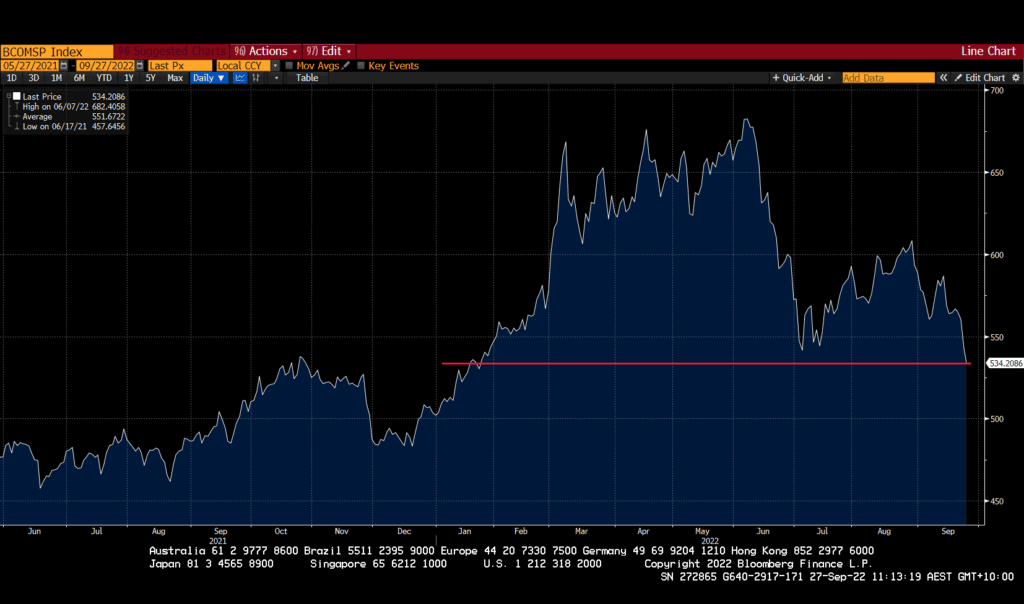

Unsurprisingly commodities also got clobbered on rampant USD strength and global slowdown concerns, with the Bloomberg Commodity Spot Index hitting its lowest level in 8 months.

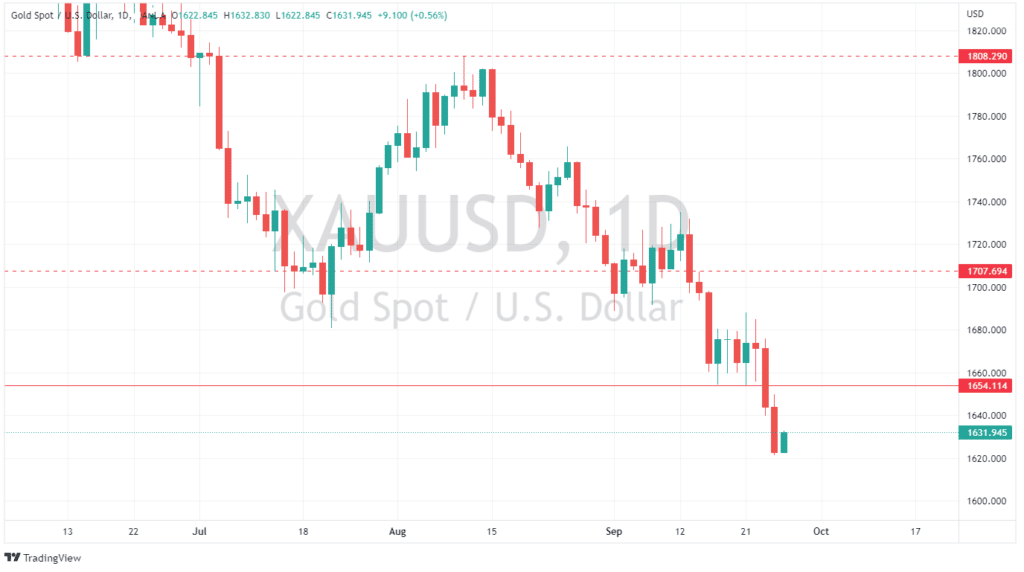

Gold continues its slide after breaking its support levels in Friday’s session, back to it’s lowest level since April 2020.

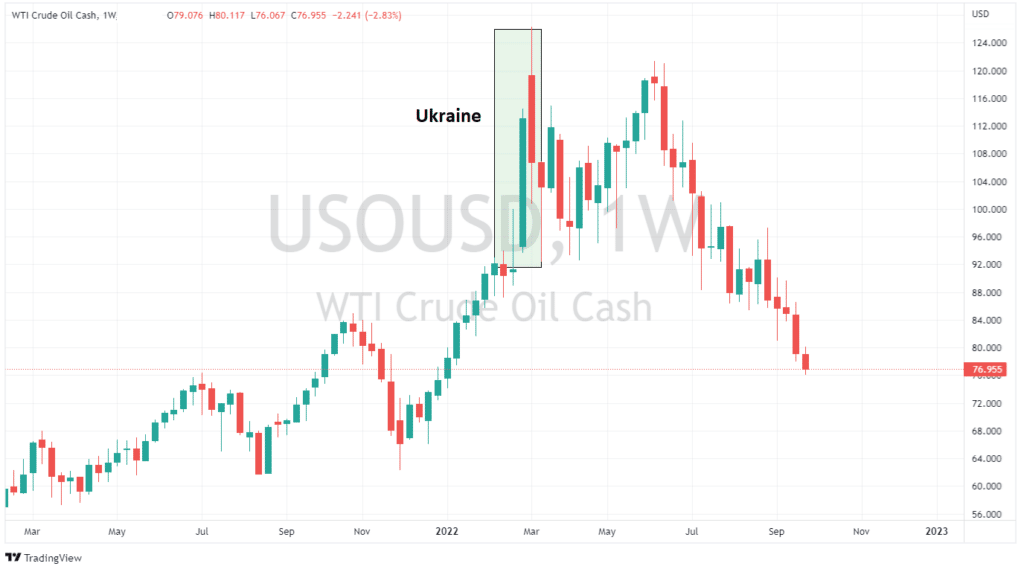

US Crude oil also got crushed, plunging below the $80 a barrel level , well under pre Ukraine invasion levels and within touching distance of the 2022 lows set in January.

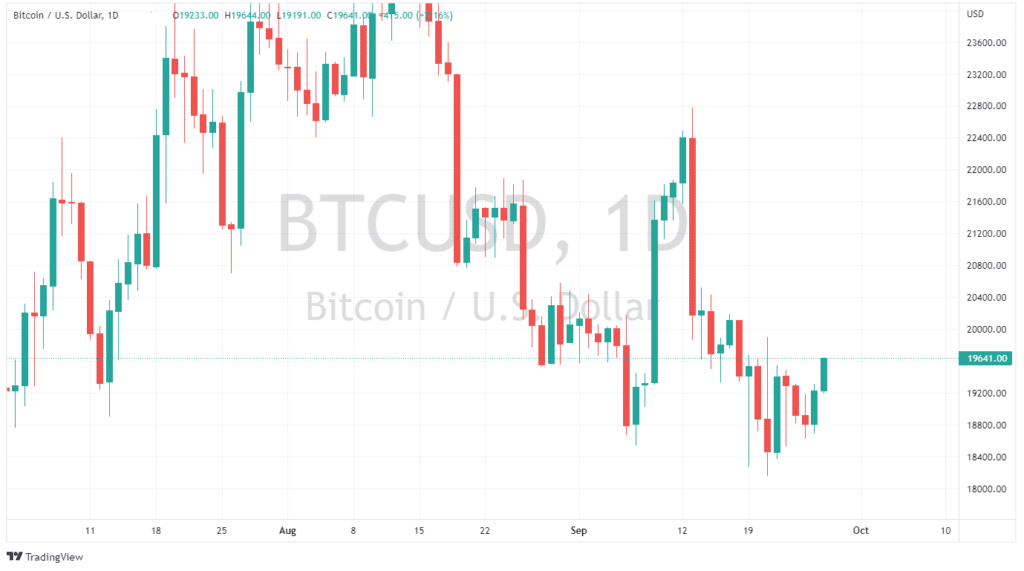

One risk asset that did perform well was Bitcoin which, despite USD strength rallied from it’s support levels to retake the 19k USD handle, turmoil in the FX market has seen BTC looking more attractive as an alternative to the USD than other currencies.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

When will the AUD find support?

The AUD has fallen to lows not since the beginning of the Covid 19 pandemic and does not look like stopping anytime soon. With global commodity prices coming down and fears of a recession causing panic sell offs the AUD has been victim to a two-fold attack. The general recession fears push growth assets including the Australian dollar downward as i...

Previous Article

Why has the GBP Collapsed to record lows?

It hasn’t been a good Monday morning for some investors or English travelers who wish to sell the GBP to go abroad, as the Sterling Pound has co...