US stocks dump in choppy session after FOMC decision

3 November 2022US equites had a wild ride over night, A strong ADP jobs report was indexes track lower at the start of the session (Good news is bad news!) only to have a euphoric lift after the FOMC statement which traders took as a dovish pivot from the Fed, only to have the party ruined by Jerome Powell’s press conference where he poured cold water on that idea. This saw the Dow Jones dump 1000 points from the high to finish down 505 points, or 1.55%.

FOMC

No surprise from the Federal Reserve as far as a fourth 75bp interest rate increase in a row, bringing the cumulative policy tightening to 375bp since March. However as expected it was the statement and press conference that traders were looking to for clues to the Feds next move and which drove market action.

Initially the FOMC statement was cheered, seeing a big rise in risk assets as it painted the picture of a slowing pace of hikes going forward. “The Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This statement suggested that they’ve done a lot of work already and it may be time to take things a little slower.

This, unfortunately for the bulls, didn’t last long as Jerome Powell took centre stage at the scheduled press conference and pulled the rug on any hopes of a full Fed pivot anytime soon. The Fed chair indicated that while the pace of hikes may slow, that the length of restrictive rates will take as long as it takes to get inflation down, this saw bond yields spike, the USD bid and equities crater as markets repriced their prediction for the Feds terminal rate.

UK rate decision

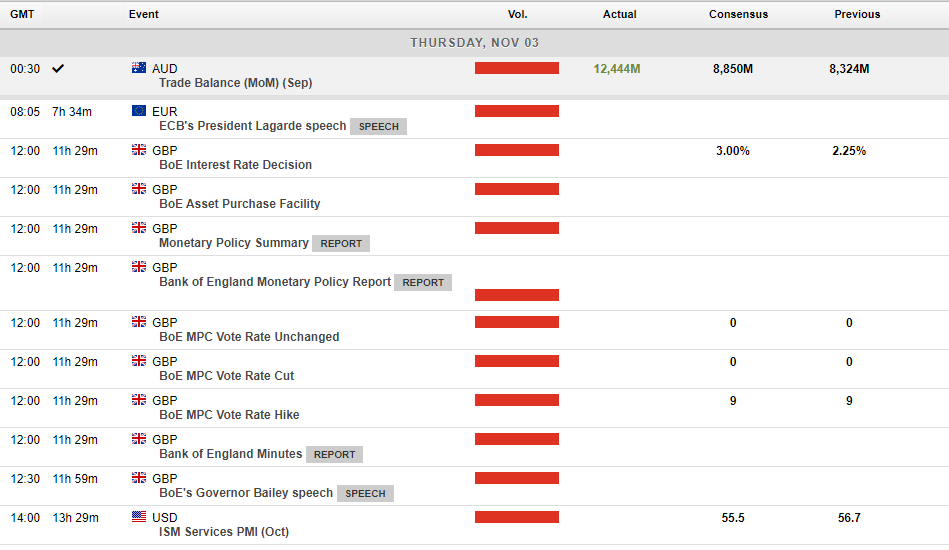

Another interesting Central Bank decision awaits the markets later today with the Bank of England releasing their interest rate decision and monetary police report.

A 75bp hike is expected by the market and is the consensus view among economists, however recent comments from Board members where they have indicated uncomfortable with the amount of tightening priced into financial markets, makes it very possible we may get a downside surprise with a 50bp hike, either way it is likely the voting members will be split and some volatility in Gilt and currency markets would be expected.

Todays scheduled economic announcements below:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Bank of England announces biggest single rate hike in 33 years

Another day, another hike. On Wednesday, the US Federal Reserve announced its latest policy decision to raise its interest rates from 3.25% to 4%, to its highest level since January 2008. On Thursday, it was the Bank of England's turn to announce its decision. As expected, the central bank raised its interest rates by 0.75% to 4%. It was the hig...

Previous Article

Airbnb sets a new quarterly record – disappoints on guidance

Airbnb Inc. (NAS:ABNB) reported its latest financial results after the closing bell in the US on Tuesday. World’s second largest online travel co...