US equities rally on softer PPI figure though upside capped on hawkish Fed rhetoric and geopolitics

16 November 2022US markets rallied in a choppy session after a softer Producer inflation figure mirrored the Consumer inflation figure from last week, giving investors optimism that US inflation may have peaked. Gains were tempered though with Fed voting members Barr and Harker both made hawkish comments regarding the Feds fight against inflation and reports of a Russian missile striking Poland.

The Dow Jones eked out a small gain of +0.17% while lower bond yields propelled the more risk-on Nasdaq to a decent gain of 1.5%

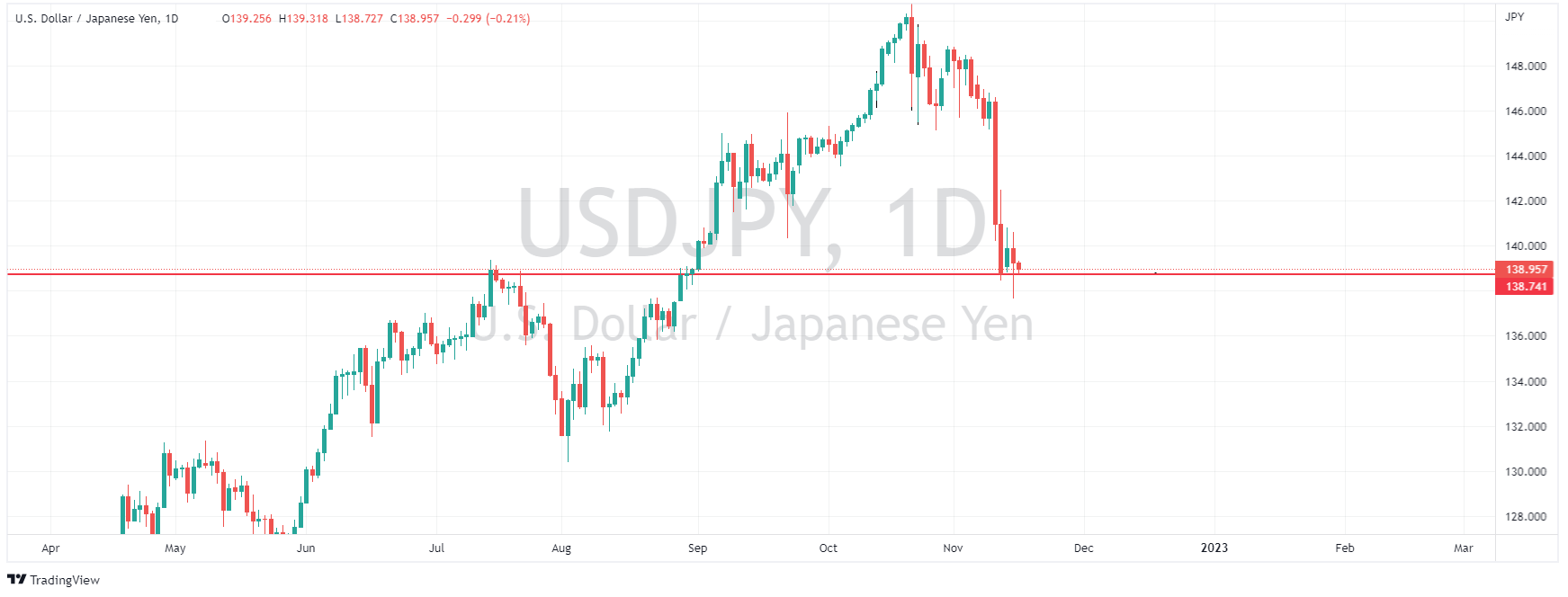

In FX markets the US dollar descent continued as the market’s view that inflation and the Fed’s peak tightening is now behind us. The USDJPY pushed below 139 to hit lows not seen since August, though buyers were found at the July high resistance level which now looks to have switched to an important support level and one worth watching as to the next move in this pair.

Cryptos tried to extend their modest rebound from Monday’s steep drop, with Bitcoin briefly rising above $17K before the Russian missile news sent it back down to session lows. it is quite clear that any news – both positive and negative – sends digital tokens tumbling testing the conviction of the HODLers.

In commodities, Crypto falling out of favour seems to be Golds gain as an alternative store of value to fiat currencies. From trading in the mid 1600’s only 2 weeks ago, XAUUSD continued it’s steep through the 1700’s and possibly on the way to testing the major resistance level at 1806.

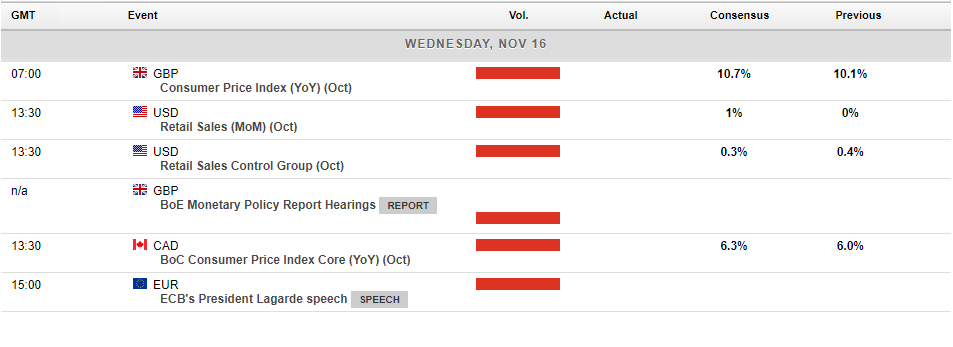

Today’s Economic announcements:

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Bitcoin ready for its next leg down?

Bitcoin has seen its price plummet after a volatile week largely due to the collapse of Cryptocurrency exchange, FTX. The price of the Bitcoin has fallen to levels not seen since November 2020. The price is now showing signs that it may be in a short-term consolidation before it may sell off again. The downward move may be amplified, especially if ...

Previous Article

Walmart posts better-than-expected Q3 results – shares move higher

Walmart Inc. (NYSE: WMT) announced its latest financial results before the market open in the US on Tuesday. World’s largest supermarket chain re...