Stocks begin Q4 with a bang as Fed pivot dreams see yields lower

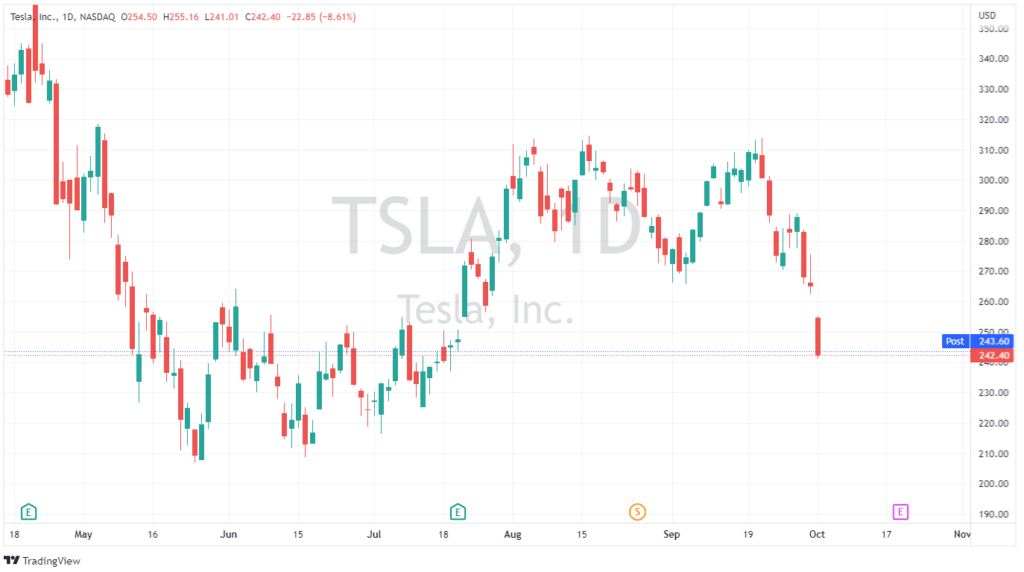

4 October 2022US stocks started with a Q4 bounce after a dismal Q3 helped by softer PMI data and perhaps extreme oversold technical conditions. Bond yields drifting lower as the market priced in a possible and highly speculative Fed pivot also bolstered equities and other risk assets. One big exception was Tesla (TSLA) cratering over 8% on a big miss on delivery expectations.

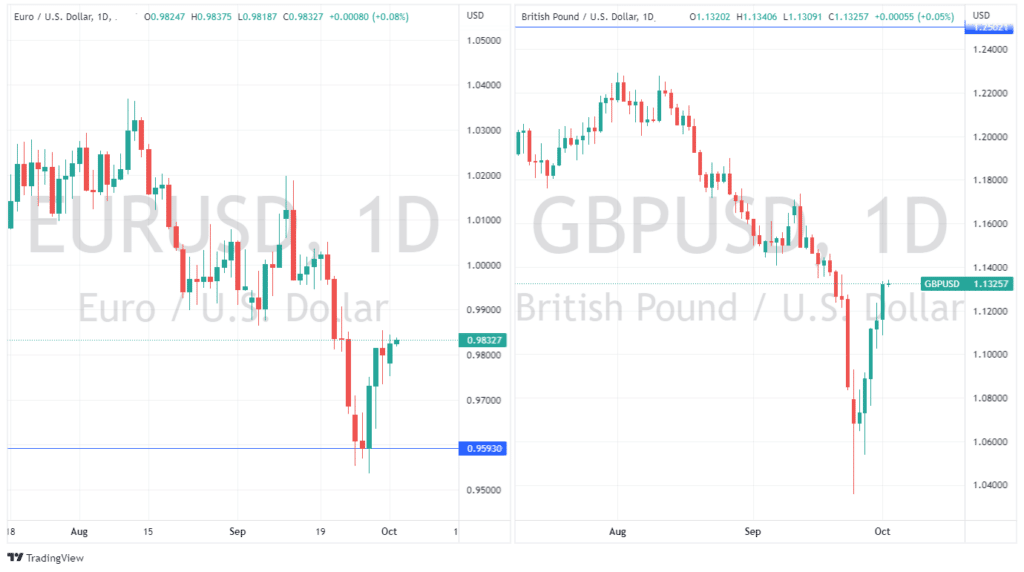

With lowering US yields causing a headwind, the USD was lower on the day. The US Dollar Index dropped back below 112 as both the recently battered Euro and GBP staged a decent up day, the latter greatly helped by reports of the UK government backflipping on previously announced tax cuts.

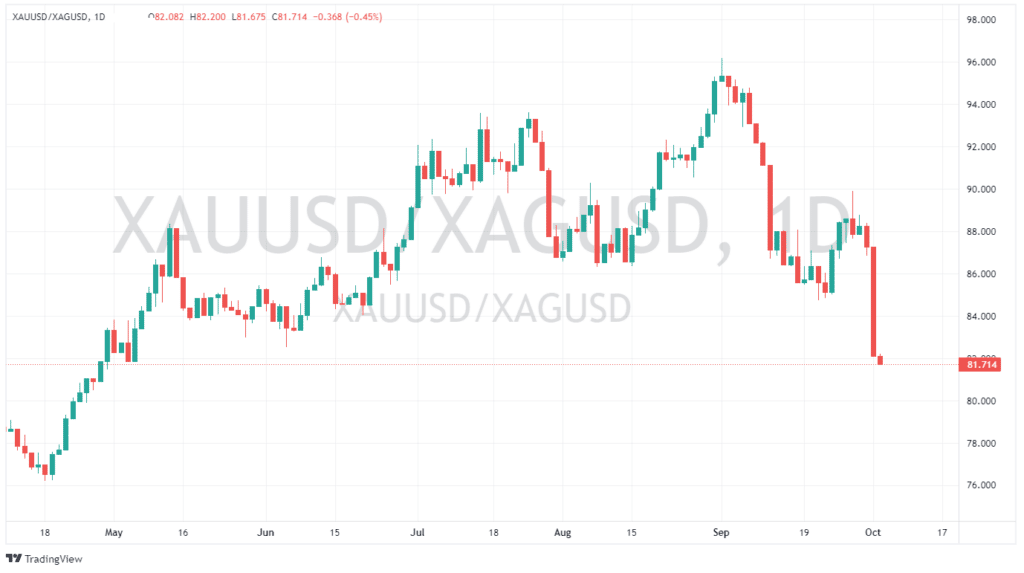

Big moves also today in precious metals with Silver (XAGUSD) soaring almost 9% on the session and Gold (XAUUSD) gaining over 2% to break back above the big psychological level of 1700 USD per ounce.

With Silver drastically outperforming Gold, the ratio of the two is back to 5-month lows, worth keeping an eye on for pairs traders.

Oil (USOUSD) also joined the party, ripping higher on dovish hopes and rumours that OPEC+ will slash production dramatically this week.

In Crypto, the improved risk sentiment also saw Bitcoin (BTCUSD) bounce after testing major support just under 19k.

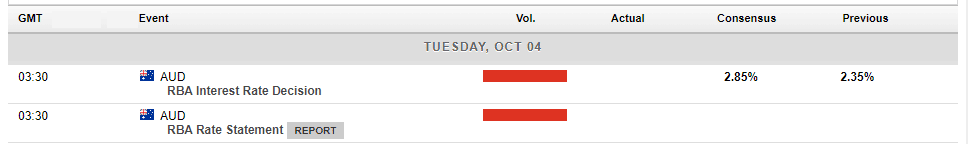

In the day ahead, Central bank action with the RBA interest rate decision at 14:30 AEDST. Rate markets are pricing in around an 80% chance of another 50bp hike.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

China Yuan’s Falls to Record lows

I have recently written a piece on the weakening of the Great British Pound (GBP) just the other day, as it looks like the dollar seems to be king at present and getting stronger against all other top currencies around the world. Today is the Chinese Yuan in focus, yesterday was the Sterling pound, who’s your money on tomorrow? We will have t...

Previous Article

Tesla sets a new record

Tesla Inc. (NASDAQ: TSLA) reported its Q3 2022 delivery numbers on Sunday. World’s largest automaker delivered a total of 343,830 cars (up by 42....