Stocks and Crypto down, Oil dumps and pumps as market goes risk off amid China COVID woes

22 November 2022US equities finished with modest losses in Mondays session of a holiday shortened week in a low volatility session. The Dow Jones dropping 45.42 points or -0.13%, the more risk sensitive NASDAQ underperforming finishing down 121.55 points or 1.09%.

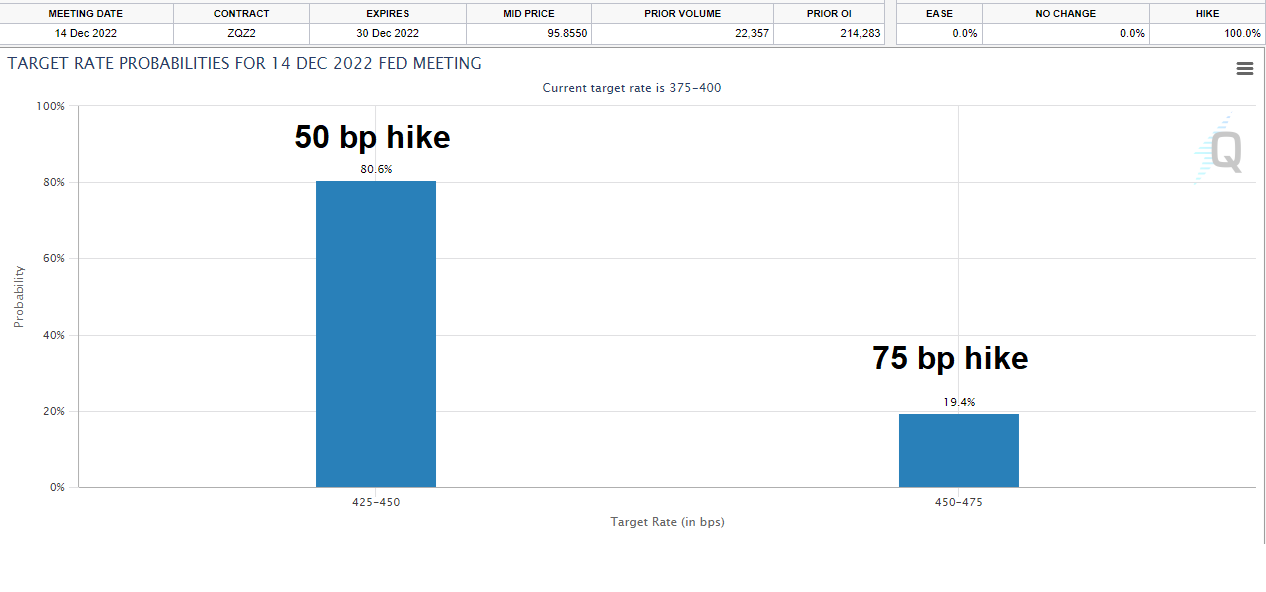

Scheduled news flow was light with only scheduled speeches from Fed voting members Daly and Mester having any weight, both re-iterated similar Fed themes of fighting inflation, but Daly’s comments were seen as dovish with comments like “Fed has more work to do when it comes to rate hikes but also must be mindful of the risk of tightening policy too much”. Though this failed to lift the markets or move any Fed expectations of the Feds next hike, with 50bp at their December meeting pretty much a lock according to rates markets.

Most the market action came out of the unscheduled releases, with soaring COVID cases, lockdowns and increased testing requirements being reported in China cast doubt on the global growth story and cast a bearish pall over the market and seeing the offshore Yuan take a tumble, another tailwind for the US dollar.

There was more pain in crypto land as the FTX hacker started dumping their Ethereum, seeing the ETHUSD tumble below 11k before finding some support, BTCUSD followed, breaking back below 16k and testing the lows set earlier in the month.

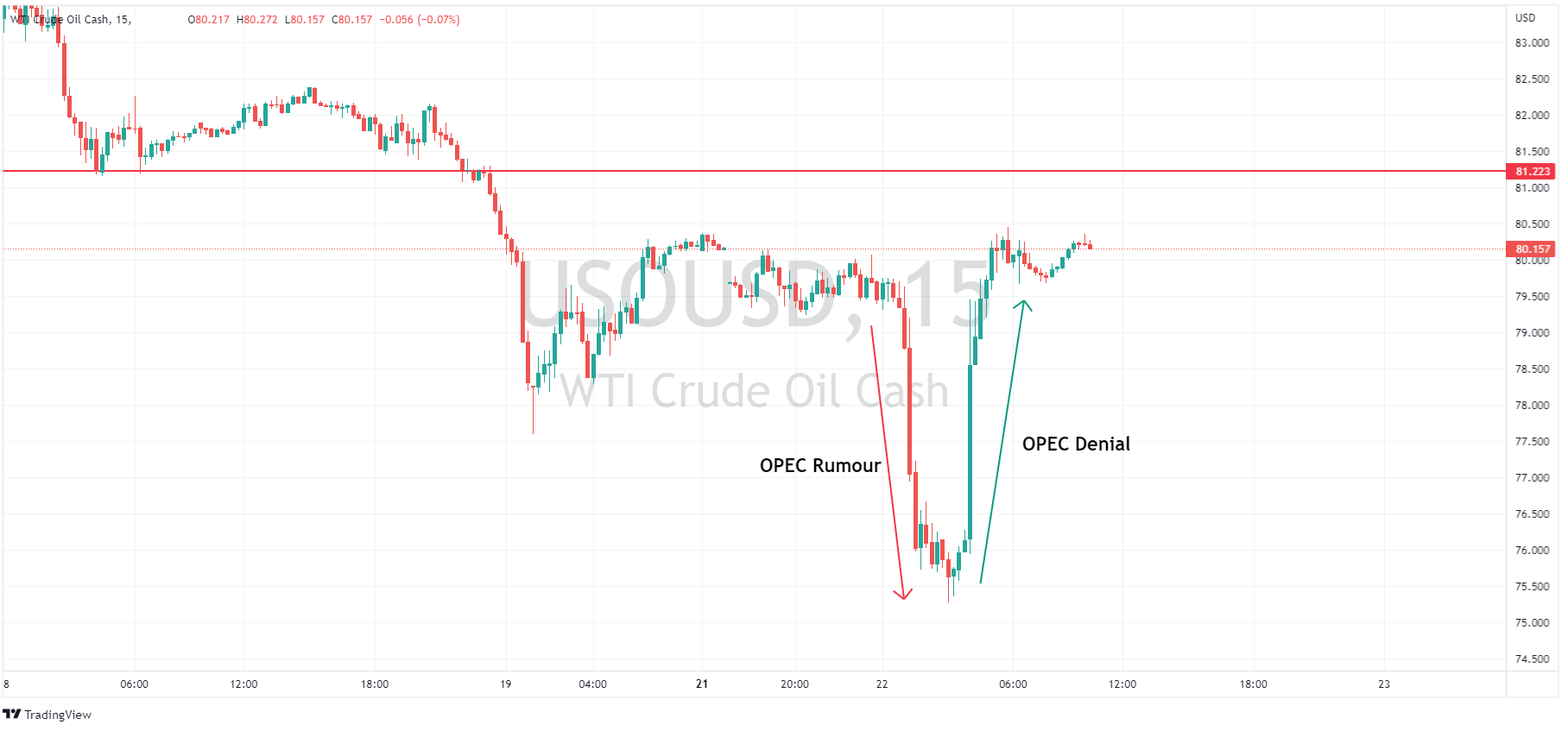

Oil had an exciting session, already under pressure from a strengthening US dollar and COVID news from China then rumours from the Wall St Journal that OPEC+ was considering production hikes saw US crude dumped down to a $75 handle. This however didn’t last long as the Saudis denying this rumour soon after seeing the price pump back up to unchanged, certainly a wild ride for Oil traders.

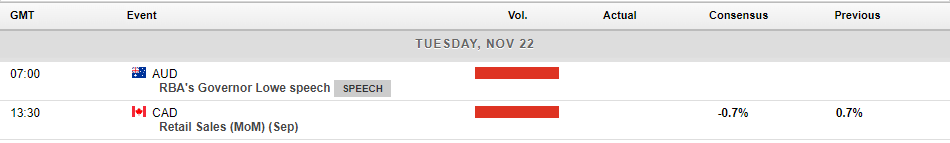

Todays economic releases are again light on the ground, with RBA governor Lowe scheduled to speak at a dinner in Melbourne (unlikely to have any real market impact) and Canadian retail sales.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

Why you need to know about Expected Value

Many traders early on in their trading journey may jump into trading without knowing if their system or edge can be profitable. The most important metric that a trader should measure their system on is by using expected value. This essentially wors out the average return that the system will return for every trade that it makes, considering both wi...

Previous Article

Zoom tops Q3 estimates

Zoom Video Communications Inc. (NASDAQ: ZM) reported third quarter financial results after the market close in the US on Monday. The US communicati...