Soft CPI figure sees Stocks, Bonds and Gold soar as the USD and yields collapse

11 November 2022Risk on was definitely back on in Thursdays US session after a softer than expected October Core CPI print, coming in at 0.3% vs the expected 0.5%, combined with broadly less-hawkish comments from Federal Reserve members Daly, Logan and Harker sparked the biggest rally in US equities since April 2020.

The rally was broad with all major US indexes posting big gains, with the recently underperforming NASDAQ surging a stunning 7.35%

It wasn’t just equities having large moves, the optimism that inflation may have peaked in the US also saw big gains in Gold, Bonds and crypto while the US dollar dropped the most in a decade as markets rushed to price in new terminal rate predictions.

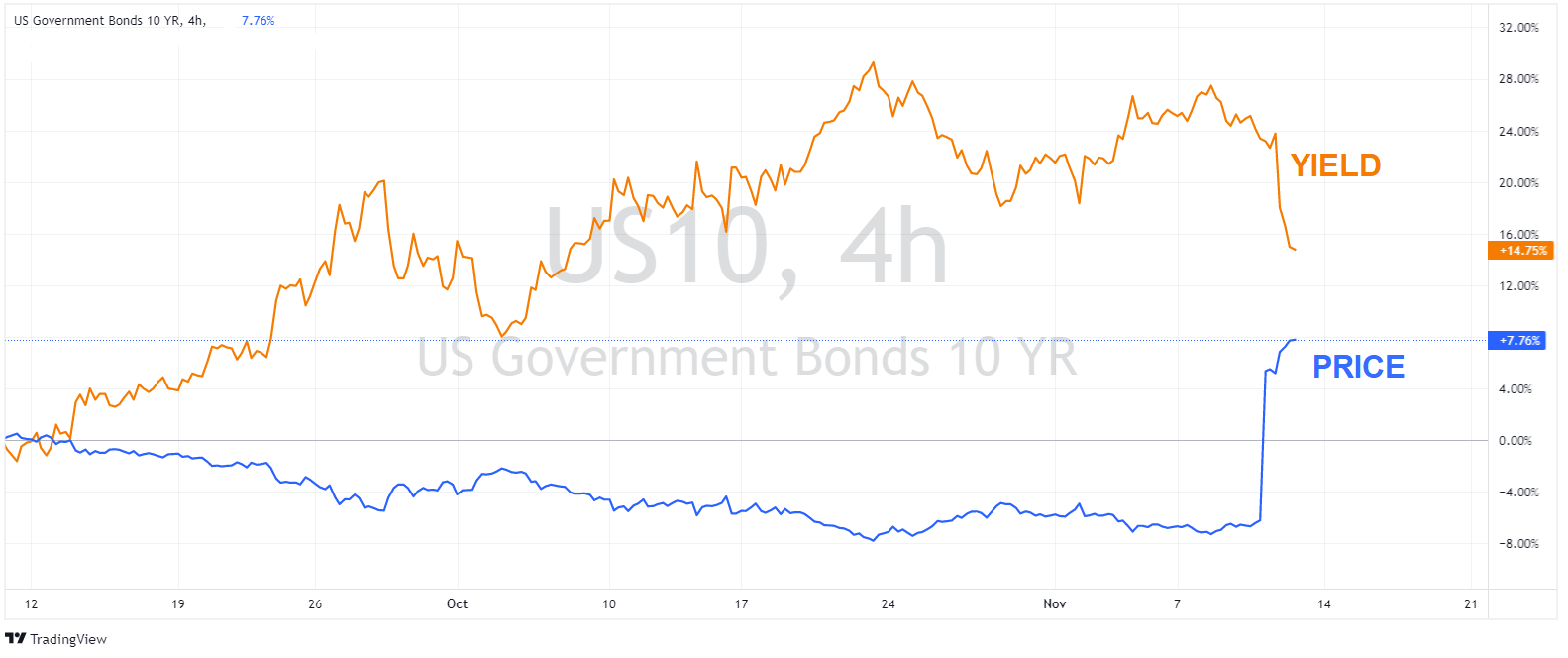

US 10-year treasury yields had the biggest collapse since March 2020, seeing bond prices break November highs (Yields and price are inverted)

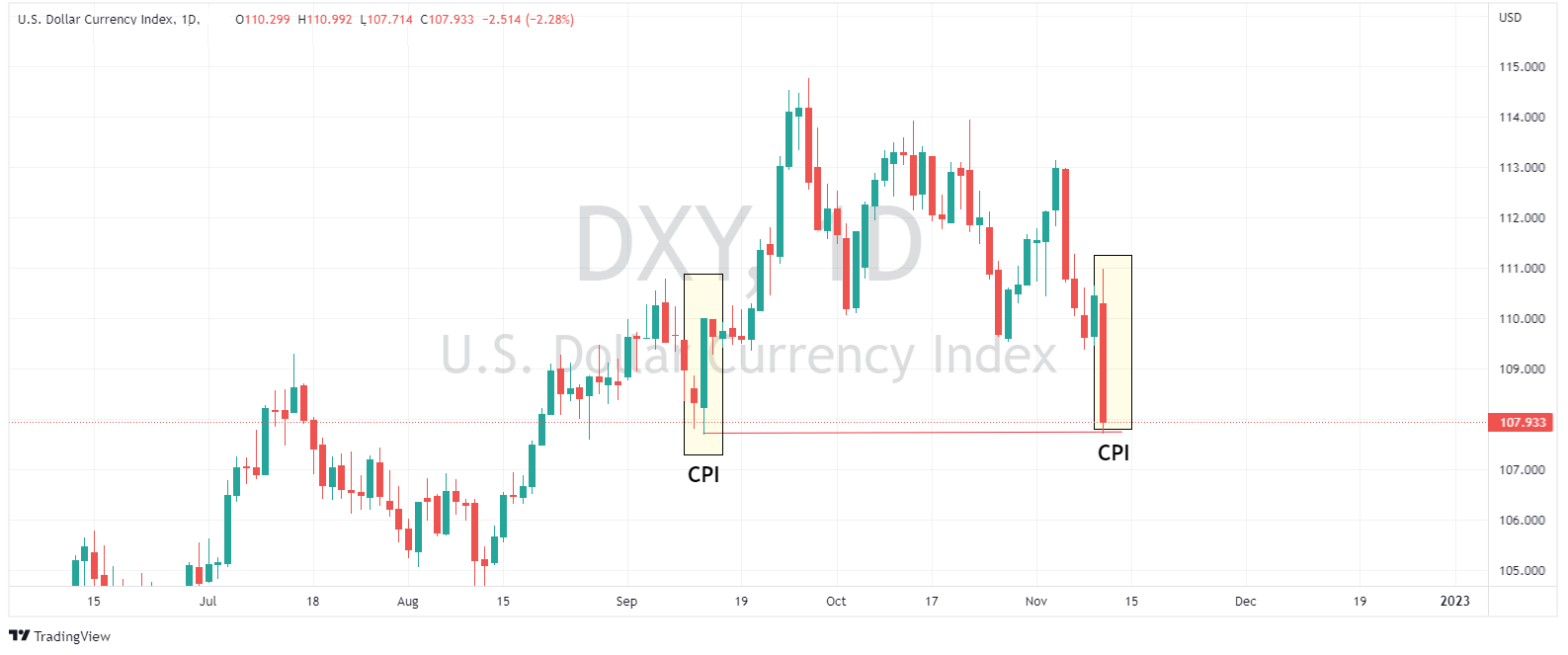

The US Dollar Index had its biggest daily drop since Dec 2015, crashing over 2% to 2-month lows. The Dollar Index has now erased all the gains since September’s hotter than expected CPI print.

Golds recent rally continued as a cratering US dollar and lower yields provided a strong tailwind that saw XAUUSD surge to almost 1760 USd per ounce, it’s highest level since August.

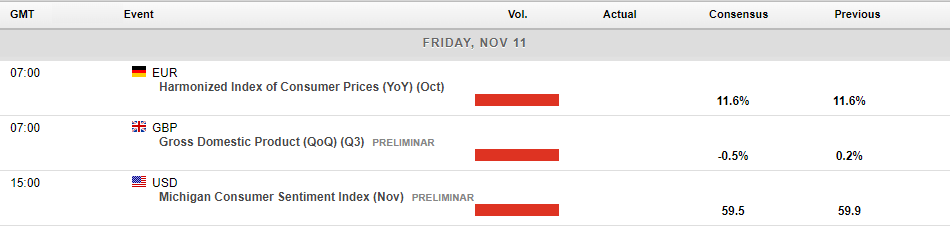

Today’s economic calendar is fairly light, the highlight being UK GDP but US consumer sentiment could also see some volatility with traders continuing to try and position for the Feds next move.

Disclaimer: Articles are from GO Markets analysts and contributors and are based on their independent analysis or personal experiences. Views, opinions or trading styles expressed are their own, and should not be taken as either representative of or shared by GO Markets. Advice, if any, is of a ‘general’ nature and not based on your personal objectives, financial situation or needs. Consider how appropriate the advice, if any, is to your objectives, financial situation and needs, before acting on the advice.

Next Article

US markets break winning streak after post CPI exuberance, cryptos down again

The US equity post CPI rally of last week ran out of steam in Mondays session as consumer inflation expectations rose and mixed messages from Federal Reserve members saw a choppy first half of the session only to see a steep decline into the close with the Dow Jones ultimately finishing down 211 points (-0.63%) Futures opened Monday with a gap d...

Previous Article

NIO falls short of expectations for Q3 – but the demand is growing

NIO Inc. (NYSE: NIO) announced Q3 financial results before the market open in the US on Thursday. The Chinese automaker fell short of analyst estimate...